The basics of any financial plan are pretty simple:

- Figure out how much is coming in

- Work out what you spend

- Spend less than you earn

- Keep the discipline

The same can be said of a calorie-controlled diet weight loss plan…

- Eat less

- Move more

- Keep the discipline

Each has its own metrics of success:

- Diet – weight loss is success

- Financial plan – portfolio increase is success

- Both can flatline!

If one week you weigh more than you did last week, you wouldn’t suddenly throw up your arms in horror, go to the pub (when they are open!) order five pints and two pies…would you?

We’d hope not and that you would keep the discipline, despite the short-term lack of progress.

SO WHY ABANDON YOUR FINANCIAL PLAN BUT STICK WITH YOUR CALORIE-CONTROLLED PLAN?

Yes, you are unhappy that you weigh more, but you know that you can try harder next week and that it should pay off. You are disciplined and sticking to your calorie-controlled plan.

Not so easy with your financial plan…

- You can cut some of your budget…

- But no matter what you try to do about the stock market, you can’t make it go up.

- You feel bad.

- Your portfolio funds will drop again, you believe.

- Sell up and hey, presto! No more drops in value.

- Comfort returns…

Congratulations, you are in the Pub and Pie Lounge of Investing and you’ll probably not leave, until it’s too late by which time you are much more overweight than when you first began.

IS THERE A LINK?

The link between both plans is that you have feelings of failure, despondency, and demotivation. You are not happy, and you are experiencing pain.

There is the belief that things won’t change. You know that they will, in time, but right now…it doesn’t feel that way.

The slight differences are, though:

- With weight loss, YOU are in control of how much you eat, how often you exercise. ALL of the calorie control plan, in fact.

- The time spans for continual progress appear to be quite small in calorie-controlled plans: daily, weekly, monthly, but it could be months or years, before you see progress on a financial plan, you believe, because you haven’t seen your portfolio rise.

In all cases, it’s about HOW YOU FEEL.

FEELINGS AND COMFORTS

Essentially, in both cases, when each of these plans aren’t going to plan, then it makes you feel uneasy, unwell, and demotivated, so you head for comfort.

In other words: you have an uneasy and trying relationship with your plan and you are looking for comfort.

- On a calorie control plan, you abandon water and celery and go for a pizza, two pints, or a bar of chocolate.

- On a financial plan: you sell your shares and bonds and its cash!

All of these will sabotage your planning:

- You know it for the calorie control plan.

and - We know it for the financial plan.

HOW TO FEEL GOOD ABOUT YOUR PORTFOLIO

What if you could feel good about your portfolio, more often than not…

Let’s see how that could be achieved.

WHAT IS A HAPPY PORTFOLIO VERSUS AN UNHAPPY PORTFOLIO?

Firstly: portfolios don’t have emotions…you do towards them and that’s it. It’s only how YOU feel. You feel pain and happiness that they simply don’t.

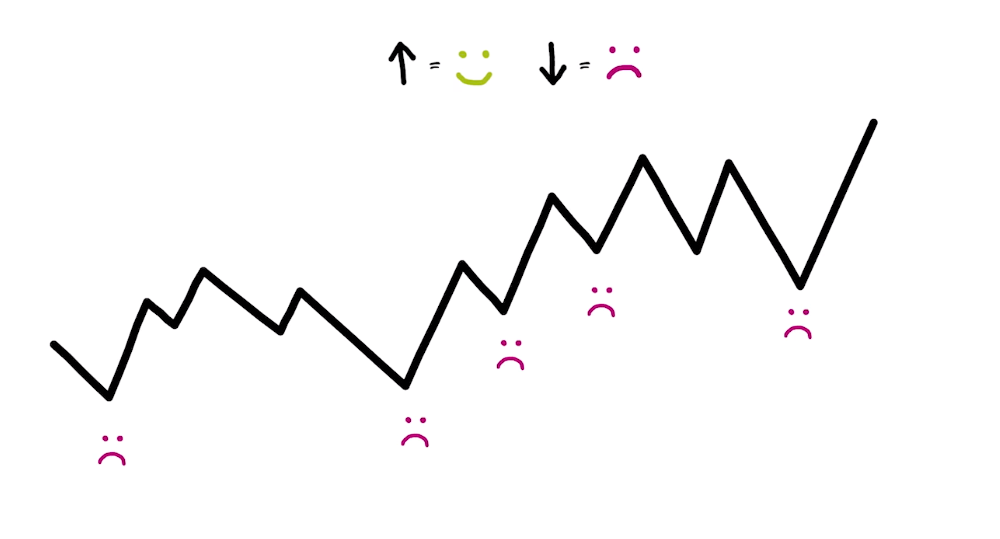

Let’s say that you are unhappy when the portfolio falls, it might look like this:

As time goes by, you are unhappy when it goes down.

OUTSOURCING YOUR HAPPINESS

As we have already discussed, you can’t control the stock market, so, to a greater or lesser extent, being happy when it rises and unhappy when it falls is outsourcing your happiness supply to someone else.

That’s likely to be a constantly painful arrangement, if we aren’t careful.

PICKING A HAPPY PORTFOLIO

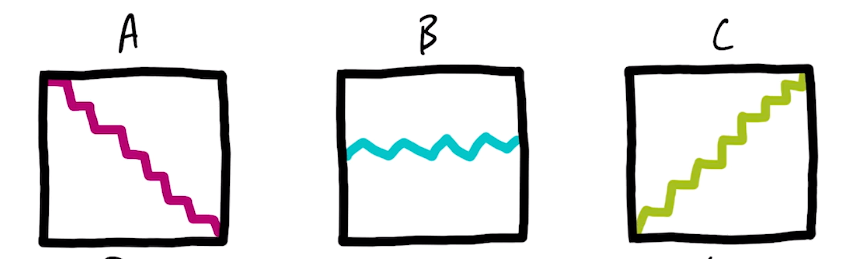

Imagine that a happy portfolio was “obvious” from outset, then those candidates might look like this:

A is going down, so by our earlier definition is unhappy – we avoid it, because it brings pains.

B is going sideways, so it’s better than A, but is there anything better?

C is going up – that’s the one for us…no pain, all gain.

HOW DO WE MANAGE TO CHOOSE THE RIGHT PORTFOLIO?

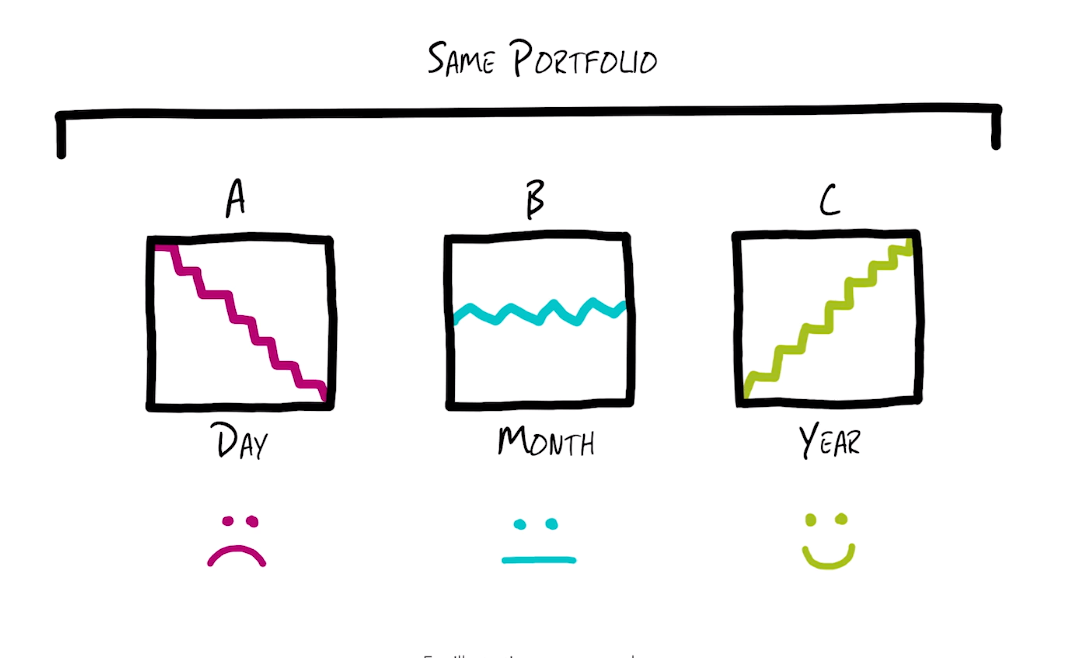

The great news is that you don’t have to make a choice between each of them, because they’re all the same portfolio, just viewed over different timescales:

This is because there is a direct relationship between the length of time that we have a portfolio and its increase in value.

- On any given day, it is almost binary (50/50) whether you will be up or down on your portfolio.

- We agree that markets rise over time, so the chance of a loss reduces over 30 (ish) days.

- And reduces further over 365 (ish) days.

USING THIS KNOWLEDGE TO STUDY YOUR PORTFOLIO

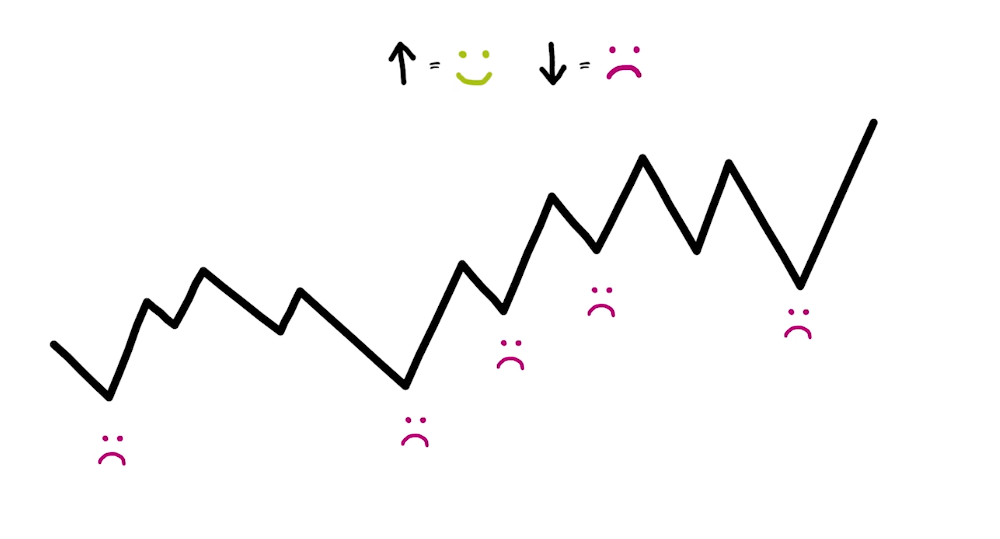

If we could quantify this by adding up all the happiness (portfolio is up) versus pain (when it drops), then it might look like this:

Let’s assume that we look at the S&P 500 (The American and therefore: the world’s largest, stock market)

- From 1980

- To 2019

- When it’s up you are happy, and you feel pain when it’s down, then…

Here are your pain scores:

- Portfolio A is viewed daily and so if you viewed it daily, then add up all of the days when it was happily up, versus painfully down, then you would have had 19 YEARS OF PAIN. Almost half of the time, you would be unhappy.

- Portfolio B is viewed monthly and so if you added up all of the months when it was painfully negative, then you would only have about 14 YEARS OF PAIN. About one-third of the time for the entire portfolio.

- Portfolio C is viewed annually and so if you added up all of the years when it was negatively down, then you would only have 7 YEARS OF PAIN.

These are the SAME portfolios, don’t forget.

In other words:

- Looking at your portfolio yearly gives you 33 years of happiness out of 40.

- Looking at it daily AND monthly, gives you an equal amount of PAIN!

CHECKING YOUR PORTFOLIO

From the above, we can see that if we check the portfolio more often, particularly when we hear alarming news, then the greater the likelihood is of feeling pain and since pain has a more lasting effect than pleasure, then we feel a disproportionate amount of pain.

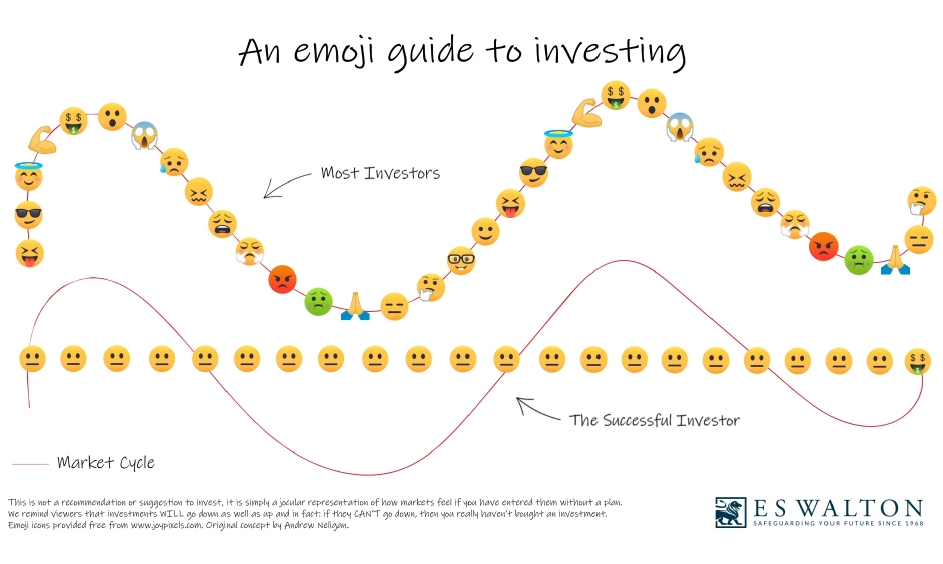

MARKETS ARE CYCLICAL

It’s important to focus on the planning which does consider the cyclical element of markets and take a long-term view.

By stepping back, we will feel more pleasure.

WHAT SHOULD BE DONE?

- Take a long-term view

- Recognize that the more often that we look at our portfolio, then the more opportunities we have for disappointment

- Accept that markets are cyclical

- Remain disciplined through market cycles

- Enjoy the 33 years of annual views than the 19 years of monthly views PLUS 14 years of daily views

Don’t outsource your happiness to a stock market that doesn’t know you and doesn’t care about you.

Don’t outsource your happiness to a stock market that doesn’t know you and doesn’t care about you.