Category: news

How to use the “gifting from income” rule to reduce your estate’s Inheritance Tax bill

According to a Citywire report, forecasts from the Office for Budget Responsibility (OBR) suggest the amount of Inheritance Tax (IHT) paid to HMRC will have increased by 11.6% in 2024/25 compared to 2023/24.

This will mean that the total amount of IHT paid in the 2024/25 financial year will have reached a record high of £8.4 billion.

The report suggests that the big year-on-year increase has been primarily driven by the long-term freeze of the level at which IHT becomes chargeable, and the increase in asset values.

With the freeze on thresholds due to continue until 2030, this highlights the importance of ensuring you are taking effective estate planning measures to mitigate the amount of IHT payable on the value of your assets. Doing this can help ensure that your beneficiaries are not left with an unwelcome and substantial tax charge on your death.

There are series of straightforward measures you can make use of to reduce your IHT liability. One of these, which is often overlooked, is known as “gifting from surplus income”.

In this article you can read about how it works, and help ensure that as much of your wealth as possible passes to your beneficiaries rather than HMRC.

Gifting assets is an effective way to reduce your IHT liability

In the 2025/26 tax year, IHT is normally charged at 40% on the value of your estate in excess of the £325,000 allowance, commonly referred to as your “nil-rate band”.

If your primary residential property is included in your estate and it is passed to a direct descendant, your total tax-free allowance will likely increase to £500,000.

It’s also important to bear in mind that these allowances apply to individuals, so a couple can enjoy a combined tax-free allowance of up to £1 million.

The most common and straightforward way to reduce your IHT liability is by gifting assets – belongings, investments, or cash – to your beneficiaries during your lifetime, so they no longer form part of your estate.

You have three annual gift allowances you can make use of:

- A £3,000 annual exemption, which can be split among as many recipients as you like. You can “carry forward” any unused allowance from one year into the next. This means that you and your spouse or partner could gift £12,000 immediately if you have not previously made any gifts

- Wedding gift allowances of £5,000 for a child’s wedding, £2,500 for a grandchild’s wedding, or £1,000 for anyone else. This exemption counts in addition to the standard annual exemption.

- Unlimited small gifts of £250 or less to other individuals, provided they have not been the recipient of another of the above exemptions.

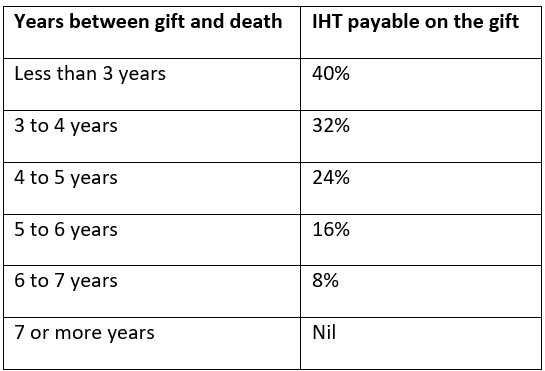

Beyond these three allowances, all other gifts you make will be treated as potentially exempt transfers (PETs) and subject to the “seven-year rule”.

This means that if you live for seven years from the date of making the PET, no IHT will be payable. Within those seven years, however, a taper relief system is applied, which means that the amount of IHT will depend on how long you live after making the gift.

As well as allowable gifts and PETs, a further effective way to mitigate your IHT liability is by utilising the “gifts out of surplus income” rule.

Gifts out of income are usually Inheritance Tax-free

Making gifts out of your regular income is an effective estate planning measure. Not only are these gifts usually IHT-free, making them carries the added benefit of you being able to provide the recipient of your gifts with valuable ongoing financial support.

While there is no limit to the amount you can gift in this way, there are three strict conditions you need to comply with:

- You must be able to demonstrate that the gifts you make are from your income, such as your salary or regular pension, rather than your accrued capital.

- The gifts must be made on a regular basis and not simply be one-off transfers.

- By gifting from your income, you must ensure that you are not reducing your own standard of living, and that the income in question is surplus to your requirements.

As well as not reducing your living standards, you will also need to assess how making such gifts on a regular basis could affect your own long-term financial plans.

You will need to review your own arrangements to confirm that the gifts you make are affordable when set against your other priorities, and that you are not creating future problems for yourself if the money you are gifting could be better allocated for other uses.

For example, you might you better off setting money aside for future care provision, or to cover moving costs if you intend to downsize to a smaller property.

You should also carefully consider how any gifts of this kind will be used. Earmarking these for a specific purpose can often be advantageous. This could include paying annual school fees for your grandchildren, or putting regular amounts into a Junior ISA, that they can then access when they are 18.

You should keep accurate records of all gifts you make

As with all your personal finance transactions, it’s important to keep detailed records of all gifts you make, whether they are out of income, within your gift allowance, or PETs.

This is certainly the case when it comes to gifts out of income and substantial PETs, as your executors are likely to need to provide these to HMRC when they are dealing with your estate on your death.

Accurate records can help expedite the process of obtaining probate, and ensure that your beneficiaries are able to enjoy your bequest to them without any unnecessary delay.

Please note: This blog is for general information only and does not constitute financial advice, which should be based on your individual circumstances. The information is aimed at retail clients only.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The Financial Conduct Authority does not regulate tax planning or estate planning.

Remember that taper relief only applies to gifts in excess of the nil-rate band. It follows that, if no tax is payable on the transfer because it does not exceed the nil-rate band (after cumulation), there can be no relief.

Taper relief does not reduce the value transferred; it reduces the tax payable as a consequence of that transfer.

Investment market update: March 2025

Trade wars and fears that tariffs could spark recessions meant investment market volatility continued in March 2025 and the start of April 2025. Read on to find out more about some of the factors that may have affected the value of your investments recently.

Tariffs imposed by US President Donald Trump affected markets negatively and, as other countries react to the measures, there continues to be uncertainty.

While market volatility and periods of downturn can be worrisome, remember it’s part of investing. Historically, markets have delivered returns over long-term time frames, even after periods of downturn, and often sticking to your investment plan makes financial sense. So, if you’re tempted to react to the news, reviewing your long-term plan and goals could be useful.

UK

Chancellor Rachel Reeves delivered the Spring Statement at the end of March, setting out the government’s spending plans, against a challenging backdrop.

The UK economy contracted by 0.1% in January 2025 when compared to a month earlier following a decline in factory output. In addition, while the rate of inflation is declining, at 2.8% in the 12 months to February 2025, it’s still above the Bank of England’s (BoE) 2% target.

The news prompted the BoE to hold its base interest rate at 4.5%, which will have disappointed households and businesses that were hoping for a cut to ease the cost of borrowing.

Data from Purchasing Managers’ Indices (PMI) was pessimistic too.

According to S&P Global, the manufacturing sector continues to face tough conditions. The headline figure was 46.9 in February. It’s the fifth consecutive month that the reading has been below the 50 mark which indicates growth. There were declines in output, new orders, and employment.

The construction data was similar, with the headline figure falling to 46.6, the biggest downturn since 2009 aside from the 2020 pandemic. There were steep declines in housebuilding and civil engineering activity.

Despite speculation that Reeves would increase taxes and reduce tax thresholds or exemptions, the Spring Statement focused on cutting the welfare budget. Indeed, the announcements made in the 2024 Autumn Budget remain intact.

Investment markets were affected by US trade wars and the war in Ukraine.

On 3 March, European leaders met in London for a summit to draw up a Ukraine peace plan. The meeting led to the pound and European stock market soaring as investors hoped for a resolution. Perhaps unsurprisingly, defence stocks saw the biggest gains, including the UK’s BAE Systems, which jumped by more than 14%.

However, the boost was short-lived. On 4 March, trade wars between the US and Canada, Mexico, and China triggered a drop of 1.27% on the FTSE 100 – an index of the 100 biggest companies on the London Stock Exchange.

There was an uptick in optimism towards the end of the month.

On 24 March, investors hoped that President Donald Trump would show flexibility ahead of the unveiling of new global tariffs in April. The FTSE 100 opened 0.5% up, with mining stocks leading the rally – winners included Anglo American (3.9%), Antofagasta (3.3%), Glencore (3%), and Rio Tinto (2.5%).

However, in early April, Trump unveiled tariffs on many countries, including the UK, which led to markets falling.

Europe

Data from the European Central Bank (ECB) shows inflation is moving closer to the 2% target. It was 2.4% in the 12 months to February 2025 across the eurozone.

The news prompted the ECB to cut the base interest rate by a quarter of a percentage point to 2.25%.

Data suggests the wider European economy is facing similar challenges to the UK.

Indeed, S&P Global PMI figures show a factory downturn. In addition, the headline PMI figure fell from 45.5 in January to 42.7 in February. Worryingly, the two largest economies in the EU, Germany and France, experienced the sharpest downturns.

The Euro Stoxx Volatility index, which tracks investor uncertainty, found stock market volatility hit a seven-month high in February and has more than doubled since mid-December 2024 due to investors feeling nervous about the global outlook.

So, it’s not surprising that there have been ups and downs for investors.

The 3 March summit in London benefited wider European stock markets. Again, defence stocks saw the biggest gains – Germany’s Rheinmetall, France’s Thales, and Italy’s Leonardo all saw an increase of at least 14%.

Expectations that US tariffs will hit the automaker industry led to stocks in the sector falling on 4 March. Among the shares affected were tiremakers Continental, which saw a 9% drop, as well as Daimler Truck (-6.6%), BMW (-5.5%), and Mercedes-Benz (-4.5%).

Similar to the UK, European markets were negatively affected by US tariffs at the start of April.

US

US inflation is nearing the Federal Reserve’s 2% target after a rate of 2.8% was recorded in the 12 months to February 2025.

However, there was negative news from the labour market. According to the Bureau of Labor Statistics, the unemployment rate edged up to 4.1% in February.

PMI readings for the manufacturing sector also reflected this trend. New orders fell in February and companies continued to lay off staff, which may suggest they don’t feel confident in the future. Yet, the sector has grown for two consecutive months.

On 3 March, in contrast to Europe, Wall Street dipped slightly. The technology-focused Nasdaq index was down 0.8% and the broader market indices Dow Jones and S&P 500 both fell 0.3%.

The following day, Trump declared 25% tariffs on imports from Canada and Mexico and 10% tariffs on imports from China. The news led to the dollar weakening, and indices tumbling further – the Nasdaq fell 2.6% and S&P 500 was down 1.7% – and the declines continued into the next week.

Technology stocks in particular have been hit hard by the market volatility. AJ Bell warned since the start of 2025, $1.57 trillion (£1.21 trillion) had been wiped off the value of the Magnificent Seven – seven influential and high-performing US technology stocks – as of 4 March.

Carmaker Tesla is among the biggest losers. As of mid-March, its share price had halved since it benefited from a post-election rally at the end of 2024, which has partly been driven by sales in the EU falling by almost 50%.

Once again, the uncertainty caused by trade wars led to volatility in the US markets.

Asia

As a country with a trade surplus and a large US market, tariffs are expected to hamper growth in China.

China’s GDP target is 5% for 2025, the same target it hit in 2024. However, economists believe replicating this in 2025 will be difficult. China succeeded in reaching the 2024 target thanks to an export boom at the end of the year – exports increased by 10.7%, as some businesses tried to beat the expected tariffs.

In contrast, between January and February 2025, Chinese imports fell by 8.4% year-on-year after economists had expected growth of 1%. The data might suggest that Chinese manufacturers are cutting back on buying raw materials and parts due to trade concerns.

Tariffs imposed by the US led to China unveiling similarly high tariffs at the start of April. The trade war is likely to affect China’s economy and its ability to reach GDP goals in 2025.

Please note: This blog is for general information only and does not constitute financial advice, which should be based on your individual circumstances. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Your Spring Statement update – the key news from the chancellor’s speech

After Rachel Reeves’ impactful first Budget in autumn 2024, you might have been concerned about the announcements that would be included in her Spring Statement on 26 March 2025.

Reassuringly, the major headline from this year’s springtime fiscal event is that Reeves made few announcements that are likely to affect you and your personal finances directly. Although, it did reveal that none of the changes made in the Autumn Budget would be overturned. However, one significant change has been made to the High Income Child Benefit Charge, which could affect you or your family.

The chancellor did announce that, due to global uncertainty and after the economy declined in January, the Office for Budget Responsibility (OBR) has downgraded its 2025 forecast for UK growth from 2% in October 2024 to 1% as of March 2025. She also noted the OBR’s long-term forecast, indicating that growth would increase for each year remaining in this parliament.

In addition to growth figures, the chancellor’s Statement introduced a range of measures designed to increase economic activity in the UK, as well as cost-saving initiatives, predominantly at state level, to reduce government debt.

Read on for your summary of the chancellor’s 2025 Spring Statement.

Personal tax thresholds and allowances are set to remain unchanged

Those who were concerned the chancellor would announce sweeping changes that might affect their personal finances will be breathing a sigh of relief as many worries didn’t materialise.

Personal tax

Reeves stuck to a pre-Spring Statement commitment to not increase personal taxes.

So, Income Tax thresholds and rates will remain unchanged, and thresholds are frozen until April 2028. As a result, your Income Tax liability is likely to rise in real terms.

Similarly, the rates and thresholds for paying Capital Gains Tax (CGT) and Dividend Tax will remain the same.

Individual Savings Accounts (ISAs)

Before the Spring Statement, the government was reportedly considering reducing the amount you can tax-efficiently place in a Cash ISA each tax year to £4,000 in a bid to encourage greater investment.

The good news is the ISA subscription limit will remain at the current level (£20,000) in the 2025/26 tax year. The ISA subscription limit is frozen until 2030.

The Junior ISA (JISA) allowance will remain at £9,000 in 2025/26.

However, the government did note it will continue reviewing ISA reform options to improve the balance between cash and equities to earn better returns for savers, boost the culture of retail investment, and support its growth mission.

Pensions

Last year, the government announced a new Pension Schemes Bill, which will legislate several areas of pension policy. However, further reforms weren’t announced in the Spring Statement.

The Annual Allowance will remain at £60,000 in 2025/26. Your Annual Allowance may be lower if your income exceeds certain thresholds or you have already flexibly accessed your pension.

As usual, there was also speculation that the amount you could withdraw from your pension tax-free would be reduced, but this has remained unchanged. So, when you reach the normal minimum pension age (55, rising to 57 in 2028), you may withdraw up to 25% of your pension (up to a maximum of £268,275) before paying Income Tax.

State Pension

As expected, there were no announcements relating to the State Pension or the triple lock, which guarantees the State Pension will increase every tax year by either the rate of inflation, average earnings growth, or 2.5%, whichever is higher.

As a result, the full new State Pension will pay a weekly income of £230.25 in 2025/26.

High Income Child Benefit Charge reforms will come into place this summer

Although the chancellor did not explicitly announce the change, the Spring Statement document revealed that those who pay the High Income Child Benefit Charge will be able to do so through PAYE from summer 2025.

As it stands, those who pay the charge need to register for self-assessment to do so, even if they do not otherwise need to self-assess. But this year, the government is making it easier for families to pay the charge without needing to submit a tax return.

Inflation is forecast to meet the Bank of England’s 2% target by 2027

After reaching a 40-year high of 11.1% in October 2022, inflation, as measured by the Consumer Prices Index (CPI), has gradually fallen, bringing it closer to the Bank of England’s (BoE) target of 2%.

The chancellor announced in her Statement that in the 12 months to February 2025, inflation rose by 2.8%, down from 3% in January. Now that inflation is better under control, the BoE has cut its base rate three times since the general election, bringing the rate down from 5.25% to 4.5%. These cuts mean borrowers will likely pay less while savers may see their interest payments fall.

It was then announced that, according to the OBR’s forecast, inflation will average:

- 3.2% in 2025

- 2.1% in 2026

- 2% in 2027, 2028, and 2029 – the BoE’s target rate.

The key fiscal announcements from the 2025 Spring Statement

The chancellor’s speech largely revolved around changes to government spending and investment. Some of the key measures and announcements included in the Statement were to:

- Increase defence spending to 2.5% of GDP by 2027, including providing an additional £2.2 billion to the Ministry of Defence next year

- Rebalance payment levels in Universal Credit to incentivise people into work, and review the assessment for Personal Independence Payments, with the OBR stating these changes will save £4.8 billion from the welfare budget in 2029/30

- Crack down on promoters of tax avoidance schemes, as initially announced in the Autumn Budget in October 2024

- Invest £2 billion in social and affordable housing, so housebuilding reaches a 40-year high that helps put the government on track to reach its target of building 1.5 million homes by the end of this parliament

- Introduce a £3.25 billion Transformation Fund to streamline public services using technology and Artificial Intelligence, making the government “leaner and more efficient”. Additionally, government departments will reduce their administrative budgets by 15% by the end of the decade.

2024 Autumn Budget changes remain intact

In October 2024, the chancellor announced a series of tax-raising measures during the Autumn Budget, some of which could have affected your personal finances. These included:

- Inheritance Tax (IHT) will be levied on unused pension benefits from April 2027.

- Agricultural Property Relief and Business Property Relief will be reduced from April 2026.

- CGT rates for non-property gains were raised in line with property rates with immediate effect, and Business Asset Disposal Relief and Investors’ Relief were both reduced.

- Employer National Insurance contributions (NICs) will rise from April 2025, from 13.8% to 15%, and the threshold at which employers start paying NICs will also fall.

- Income Tax thresholds will remain frozen until 2028.

- The IHT nil-rate bands will remain fixed for a further two years, until 2030.

- VAT was levied on fee-paying schools, effective from 1 January 2025.

- The non-dom tax regime is set to be abolished from April 2025.

- The Stamp Duty Land Tax surcharge on second home purchases rose from 3% to 5% from 31 October 2024.

- Corporation Tax is now capped at 25% for the duration of the parliament.

While many hoped the chancellor would row back on some or all of these measures, all remain intact.

Please note

All information is from the Spring Statement documents on this page.

The content of this Spring Statement summary is intended for general information purposes only. The content should not be relied upon in its entirety and shall not be deemed to be or constitute advice.

While we believe this interpretation to be correct, it cannot be guaranteed and we cannot accept any responsibility for any action taken or refrained from being taken as a result of the information contained within this summary. Please obtain professional advice before entering into or altering any new arrangement.

How to stop following the investment crowd and stick to your strategy

We’re only weeks into 2025, and it’s already been one filled with market volatility and uncertainty. At times like this, being part of a crowd might feel comforting, but following the investment decisions of others could lead to choices that aren’t right for you.

Political and economic uncertainty means investors may already have experienced the value of their investments falling this year. In fact, towards the end of January, you might have been affected by the value of US technology stocks falling sharply.

The sudden emergence of Chinese AI app DeepSeek, which rivals US AI technology at a fraction of the cost, led to some investors questioning whether the US’s dominance in the sector would continue.

According to the BBC, following the release, Nvidia, which makes chips for AI, saw share prices fall 17% on 27 January – the biggest single-day loss in US market history. The next day, the share price began to recover but remained significantly below where it had been the previous week.

It wasn’t only Nvidia that was affected either, many other US technology businesses experienced a fall in share prices. Indeed, the Nasdaq – a technology-focused US index – was down 3.5% when markets opened on 27 January.

With other investors seemingly selling off their US technology stocks, you might have been tempted to follow the crowd and do the same.

Market volatility can trigger herd instinct among investors

Herd instinct is a type of financial bias where people join groups to follow the actions of other people. When investing, it might mean you make similar investments to others or that you sell your investments when share prices fall. In fact, herd instinct at a large scale could lead to market crashes or create asset bubbles.

It’s easy to see why this happens. Being part of a crowd can offer a sense of comfort, especially during periods of uncertainty. In contrast, standing out from the crowd could mean you feel vulnerable or that you’re making a mistake by going against the grain.

So, following the crowd may feel like the sensible option. After all, if everyone else is doing it, it must be the right decision.

Yet, it’s not as straightforward as that. In fact, herd mentality could harm your long-term plans and wealth.

When following the lead of others, you might assume they’ve already carried out research, so you skip analysing the decision. The other investors could also be acting based on herd instinct or making a decision that’s right for them, but that doesn’t automatically mean it’s the right option for you.

3 useful strategies that could help you focus on your own path

While it can be difficult to not compare your investment decisions with those of others, remember, with different goals and circumstances a great investment for one investor isn’t right for another.

So, here are three useful strategies that could help you focus on following your own investment path.

1. Develop a clear investment plan

One of the key steps to reducing the effect of herd mentality on your decisions is to have a developed investment plan. By outlining your objectives, you’re in a better position to understand the types of opportunities that are right for you.

If you have confidence in your investment strategy, you’re also less likely to be tempted to make changes. For example, if you know your investments are on track to provide “enough” to reach your long-term goals, taking additional risk for a chance to secure higher returns might not be as appealing.

As a financial planner, we can help you create an investment plan that provides you with a clear direction.

2. Diversify your investments in a way that reflects your plan

One of the challenges of investing is keeping emotions in check. You’re more likely to follow the crowd when the market or your investments face a sharp fall or rise. It might mean you feel uncertain about the investments you’ve chosen, so you start to look at what others are doing.

Diversifying won’t shield you from all market movements, but it could mean you’re less exposed to volatility. By investing in different asset classes, sectors, and geographical areas, when one part of your portfolio experiences a dip, it could be balanced by gains in another. As a result, it may mean the value of your investments is less likely to experience large fluctuations and limit knee-jerk decisions.

3. Be aware of your investment risk profile

All investments involve some risk. However, the level of risk can vary significantly.

So, understanding risk could mean you’re able to confidently pass by opportunities that you know involve more risk than is appropriate for you even if it seems like everyone else is investing in it.

Contact us to talk about your tailored investment strategy

If you’d like to talk about how to invest in a way that aligns with your goals and circumstances, please get in touch. We can work with you to create a tailored investment strategy that may give you confidence in the steps you’re taking.

Please note: This blog is for general information only and does not constitute financial advice, which should be based on your individual circumstances. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Plans changed? Updating your financial plan could offer reassurance

Even the best-laid financial plan might need to change at times. If you find yourself in that position, you might benefit from reassurance that you can still reach your goals and will be financially secure.

There’s a whole host of reasons why you might want to adjust your financial plan.

In some cases, it might be a decision you’ve made. Perhaps you’ve decided you want to gift money to loved ones to help them reach their goals, or you want to take a higher income from your pension to fund a new-found hobby.

Other times, the changes might be due to factors outside of your control. For example, if you’ve been made redundant, you might need to create an income until you can find a new position.

Whatever the reason, it can be scary to change course. One cause of apprehension might be the fear of the unknown. Fortunately, updating your financial plan could help you feel more in control and confident.

Updating your cashflow model could help you analyse the impact of the changes

When you create a financial plan, one useful tool that you might use is a cashflow model.

You start by inputting some basic financial information into the model. For example, you might add the value of the assets you hold now, your income, and your outgoings.

One of the key benefits of a cashflow model is that it can help you visualise how your wealth might change over time.

So, you need to provide information to allow it to create a forecast too. This data often falls into two categories:

- Your actions – These would be the financial steps you plan to take, such as how much you plan to contribute to your pension each month or the amount you’ll add to an emergency fund.

- Assumptions – Some factors may affect your finances that are outside of your control, so for these areas, you may make realistic assumptions. For example, you might review your pension and include average annual returns of 5%.

With these details, a cashflow model can project how your assets and wealth may change and even look decades ahead so you can consider long-term goals.

As a result, cashflow modelling can help you understand if the steps you’re taking now are enough to secure the future you want. But it’s not just useful when everything is going to plan, a cashflow model may be even more valuable when you face unexpected changes.

It’s important to note that the projections from a cashflow model cannot be guaranteed. However, it can provide a useful indicator and highlight where there could be potential gaps in your financial plan.

A cashflow model could help you assess the short- and long-term impact of your new plans

So, you’ve worked with a financial planner and created a cashflow model that aligned with your aspirations. But now, your plans have been derailed. Luckily, you can update the information and model your new circumstances or goals.

Let’s say you’d previously planned to retire at the age of 65. However, ill health has forced you to step back from work five years sooner than you expected. You might have questions like:

- Can I afford to take an income from my pension in line with my previous plan?

- If I had to take a lower income, how would it affect my lifestyle?

- Are there other assets I could use to supplement an income from my pension?

- Could retiring sooner affect the value of the estate I leave behind for loved ones?

You can alter the information that goes into your cashflow model to help you answer these questions. So, in the above scenario, you might see how taking the same income you’d previously planned but five years earlier affects your risk of running out of money during your lifetime.

You might find that you have enough to be financially secure and can move forward with your retirement plans.

Alternatively, you may find that your new plan might leave you in a financially vulnerable position in the future. In this case, you can use the cashflow model to try different solutions to understand what might work for you.

By realising there’s a potential shortfall sooner, you’re in a better position to bridge gaps or find a different option, so you’re able to proceed with confidence.

Get in touch to update your financial plan

If your circumstances or goals have changed, you can arrange a meeting with our team to update your financial plan. It could help you assess the potential long-term implications of the changes and understand what steps you might need to take to keep your plan on track.

Please note: This blog is for general information only and does not constitute financial advice, which should be based on your individual circumstances. The information is aimed at retail clients only.

The Financial Conduct Authority does not regulate cashflow modelling.

Fiscal drag: How threshold and allowance freezes affect you

Despite intense speculation that the Labour government would slash tax allowances and exemptions, many are set to remain the same in the 2025/26 tax year. While that might seem like something to celebrate, fiscal drag could mean your tax liability increases in real terms.

To maintain allowances and exemptions in real terms, the government would need to increase them by the rate of inflation.

So, when they are frozen instead, your taxable income is likely to increase as you might be “dragged” into paying tax or paying tax at a higher rate. This generates higher revenues for the government without increasing tax rates. For this reason, freezes are sometimes called “stealth taxes”.

Several tax thresholds have been frozen since April 2022 and aren’t expected to rise until April 2028. When you consider the period of high inflation experienced recently, the effect of fiscal drag could mean you’ve paid a significantly higher proportion of tax, relative to your income, than you did previously.

Income Tax: Thresholds are frozen until April 2028

The previous Conservative government froze Income Tax thresholds in 2022 until April 2028. The current Labour government has said it will continue the freeze.

During the freeze, it’s likely that your income will rise, which would maintain your spending power. However, as the thresholds will not increase, your tax liability might also rise. It may seem like a small increase initially, but it can add up over the years.

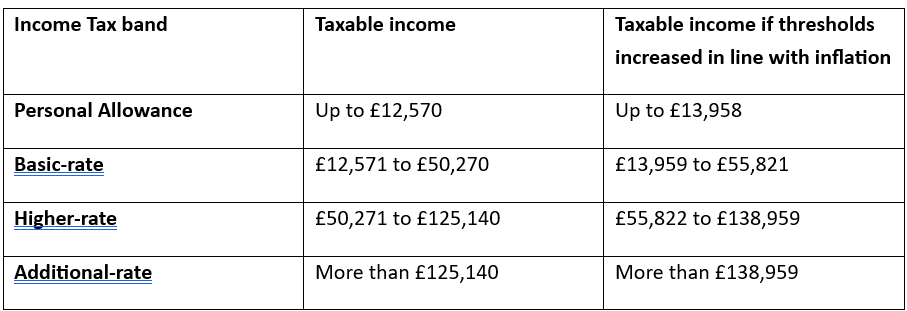

The table below shows how the value of Income Tax thresholds would have changed if they had increased in line with inflation between January 2022 and November 2024.

Source: Bank of England

With the freeze expected to remain in place for another three years, the effects of fiscal drag will become more evident.

According to the Office of Budget Responsibility (OBR), freezing Income Tax thresholds mean that between 2022/23 and 2028/29, an extra 4 million people will pay Income Tax. In addition, 3 million will be dragged into the higher-rate tax band and 400,000 will pay the additional-rate of Income Tax for the first time.

The fiscal drag is estimated to raise £42.9 billion in tax by 2027/28.

The OBR noted frozen thresholds are the largest contributor to the rising overall economy-wide tax burden. The freeze will be responsible for almost a third of the 4.5% GDP increase in taxes from 2019/20 to 2028/29.

Freezes to Inheritance Tax thresholds and ISA limits could affect your finances too

It’s not just freezes to Income Tax you may need to be mindful of either. Frozen allowances include the:

- Inheritance Tax thresholds: The nil-rate band is frozen at £325,000 – it has been at this level since 2009/10 and will remain the same until April 2028. The residence nil-rate band last increased to £175,000 in 2020/21 and is also frozen until the start of the 2028/29 tax year.

- ISA allowance: The amount you can add to your ISA each tax year is frozen at £20,000 for adults and £9,000 for children until 5 April 2030. The amount you can pay into an adult ISA hasn’t increased since 2018/19, and Junior ISAs last increased in 2020/21.

There are other allowances and exemptions that, while not frozen, haven’t increased in line with inflation either.

For example, the amount you can gift in a tax year that will be immediately outside of your estate for Inheritance Tax purposes is known as the “annual exemption”. In 2024/25, the annual exemption is £3,000 and it’s been at this level since 1981.

If the annual exemption had increased in line with inflation between 1981 and November 2024, it’d stand at £11,314.

A financial plan could help you minimise the effects of fiscal drag

While you can’t change tax thresholds or allowances, there might be steps you can incorporate into your financial plan to reduce your overall tax bill.

For instance, increasing your pension contributions could reduce your taxable income and mean you avoid being dragged into a higher Income Tax bracket. While it may mean your take-home pay is lower, it could support long-term retirement goals and may be right for you as a result.

In addition, while the ISA allowance is frozen, if you’re not already depositing the full amount, increasing how much you add to your ISA may reduce your Income Tax bill.

Interest earned on savings that aren’t held in a tax-efficient wrapper, like an ISA, could become liable for Income Tax if they exceed your Personal Savings Allowance (PSA). The PSA is £1,000 if you’re a basic-rate taxpayer, £500 if you’re a higher-rate taxpayer, and £0 if you’re an additional-rate taxpayer.

If you’d like to talk about how fiscal drag may affect your finances and the steps you might take to mitigate the effects, please get in touch.

Please note: This blog is for general information only and does not constitute financial advice, which should be based on your individual circumstances. The information is aimed at retail clients only.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

3 important variables that could affect your sustainable pension withdrawal rate

Retirement is an exciting milestone, with more free time to dedicate to the things you enjoy. Yet, it can also be a daunting time, especially when it comes to managing your finances.

Flexi-access drawdown is a popular way to access your pension savings as it provides flexibility and means you’re in control of your income. However, it also means you’re responsible for ensuring you don’t run out of money.

With the pressure of managing pension withdrawals, it’s perhaps unsurprising that a study in IFA Magazine found that almost half of retirees are worried about spending too much too soon.

Indeed, statistics from the Financial Conduct Authority indicate some retirees could be withdrawing money from their pension at an unsustainable rate.

For example, more than 30% of people accessing a pension with a value between £100,000 and £249,000 in 2023/24, withdrew at least 8% of their pension. Some of these people may have other pensions or assets they could use to fund retirement, but others could find they face a shortfall in the future because they’re accessing their pension at an unsustainable rate.

One of the challenges of managing pension withdrawals is that some factors are outside of your control.

The known unknowns of retirement

When you’re planning your retirement income, you’re likely to need to consider known unknown factors – you know they will affect your retirement plan in some way, but accurately predicting exactly how they’ll affect you at the start of retirement isn’t possible.

The list of known unknowns might be lengthy and some won’t affect all retirees. However, there are three key variables that most retirees could benefit from considering when calculating their sustainable pension withdrawal rate.

1. Life expectancy

If you knew how long your pension needed to provide an income, you could simply break it down into even blocks and rest assured that you wouldn’t run out.

In reality, you don’t know how long your pension needs to last. The average life expectancy could provide a useful indicator, but it’s far from certain.

According to the Office for National Statistics, a 65-year-old man has an average life expectancy of 85. However, he also has a 1 in 4 chance of reaching 92 and around 1 in 10 will celebrate their 96th birthday. For a 65-year-old woman, the average life expectancy is 87, with a 1 in 4 chance of reaching 94 and around 10% will celebrate their 98th birthday.

So, if you based pension withdrawals on the average life expectancy, there’s a chance that you could outlive your pension by a decade or more.

As a result, erring on the side of caution when calculating how long you’ll spend in retirement could be useful. A retirement plan could help you balance long-term financial security with enjoying your early years of retirement.

2. Inflation

The income you’ll need to maintain your lifestyle during retirement is unlikely to be static. Instead, inflation will usually mean your income will need to increase each year.

The Bank of England (BoE) has an annual inflation target of 2%. While this might seem like it’ll have little effect on your income needs, over decades it could add up. In addition, the recent period of high inflation has highlighted that the cost of goods and services can rise at a faster pace.

According to the BoE, if you retired in 2018 with an annual income of £40,000, just five years later your income will need to have increased to almost £50,000 just to provide you with the same spending power.

Failing to consider the effect inflation might have on your needs and wealth could derail your plans.

Indeed, an IFA Magazine report suggests the number of retirees searching for a job increased by 16% in 2024 when compared to a year earlier due to rising living costs.

3. Investment performance

One of the potential benefits of choosing flexi-access drawdown is that your pension will usually remain invested. This provides an opportunity for your pension to generate investment returns.

However, it’s not always straightforward. The performance of your investments could have a direct effect on the sustainable withdrawal rate.

For instance, during a downturn, you’d need to sell a greater proportion of your pension investments to achieve the same income. This could mean you deplete your pension quicker than expected and leave a potential shortfall in the future.

When weighing up the effect of investment performance, you might need to consider questions like:

- What are my expected investment returns?

- What is an appropriate level of risk for me in retirement?

- How should I manage pension withdrawals if the value of my pension falls?

Regular reviews could help you assess investment performance and make adjustments to your retirement income when appropriate.

Other unexpected factors could affect your retirement finances too

It’s not just these three known unknowns of retirement that could affect your finances, either. Other variables outside of your control might affect your income needs too, from emergency repairs to your home to care costs later in life.

When creating a retirement plan, adding a buffer and carrying out regular reviews could help you manage your finances and feel confident about the future.

Get in touch to talk about creating a sustainable retirement income

Contact us to talk about your retirement plans and how you might manage financial variables, including known unknowns. A retirement plan could give you confidence in your finances and mean you can focus on enjoying the next chapter of your life.

Please note: This blog is for general information only and does not constitute financial advice, which should be based on your individual circumstances. The information is aimed at retail clients only.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates, and tax legislation may change in subsequent Finance Acts.

How to pass on assets to vulnerable family members

When creating an estate plan, there might be people you want to pass wealth to but they’re not in a position to manage their finances. Using a trust could provide a way to leave a vulnerable loved one assets and feel confident they’ll be effectively managed.

Trusts aren’t used as commonly as other ways to pass on wealth, such as gifting or leaving an inheritance directly. In fact, according to government figures, there were only around 733,000 trusts and estates registered on the Trust Registration Service as of March 2024. Yet, in some circumstances, a trust could present a valuable option.

There are many reasons why you might consider someone vulnerable or not want to pass on assets directly to them. You might consider using a trust if you want to pass on wealth to:

- A child

- A person at risk of financial abuse

- Someone who has made poor financial decisions in the past

- An adult who has a disability that affects their ability to manage finances.

A trust may allow you to improve the financial security of loved ones without them being responsible for managing assets.

A trust means someone you choose can manage assets on behalf of beneficiaries

A trust is a legal arrangement that you (the settlor) set up where assets are managed by a person or people (the trustee) for the benefit of one or multiple other people (the beneficiary).

So, while the beneficiary may benefit from the assets, it’s the trustee who will manage them. As the settlor, you can set out how and when you want the assets, and any income they generate, to be used.

For instance, if you want to pass on wealth to your grandchild, you might name their parents as trustees. You could state money may be withdrawn from the trust to cover educational costs and, once the child turns 25, they can withdraw and take control of the remaining assets.

Or, if you want to provide for a disabled adult, you might create a trust that states the trustee is to provide the beneficiary with a regular income for the rest of their life.

Crucially, as the settlor, you can set the terms of the trust so that it suits your goals.

You should note that there are several different types of trust and, once set up, it can be difficult or impossible to reverse the decisions you’ve made. So, seeking professional legal advice if you think a trust could be an option for you may be valuable.

3 important questions to consider if you’re thinking of using a trust

Before you set up a trust, it’s important to consider if it’s the right option for you. Here are three essential questions that may help you start to weigh up the pros and cons.

1. Who would act as the trustee?

Choosing someone to act as a trustee can be difficult, so you might want to consider who you’d ask.

You want a person you can trust to act in line with your wishes and in the best interest of the beneficiaries. However, you may also want to think about the skills they have – are they comfortable handling finances? Are they organised enough to manage the trust effectively?

You can choose more than one trustee, and set out whether you’d like them to make decisions together. You may also choose a professional to act as a trustee, such as a solicitor or financial planner, who would charge a fee for their services.

2. What would be the aim of the trust?

Thinking about the reasons for creating a trust is essential, as it might affect the type of trust that’s right for you and the terms you set out.

For example, a trust that’s simply holding assets until a certain date could be very different from one you want to use to preserve family wealth for future generations.

In some cases, you might find that an alternative option is better suited to your needs.

Let’s say you want to set money aside for your grandchild to access when they turn 18. A Junior ISA (JISA) allows you to save or invest up to £9,000 in 2024/25 tax-efficiently on behalf of a child. The money held in a JISA is locked away until they reach adulthood. So, it might be more appropriate and avoid the complexity a trust may add.

3. How much control would you give the trustee?

If you have a clearly defined idea about how you want the trust to operate, you might choose to set out exactly when the assets can be used. Alternatively, you may give more control to your trustee and allow them to use their judgment.

There isn’t a right or wrong answer, so focusing on what’s important to you is key.

When setting out terms or restrictions, you may want to spend some time weighing up different scenarios and the effect they might have.

For instance, if you want the trust to provide a defined income, you might want to consider:

- How the trustee should adjust the income for inflation

- Whether they can withdraw a lump sum in certain circumstances

- If there is a point you want the beneficiaries to take control of the assets.

Rigid restrictions could have unintended consequences.

Let’s say your loved one has an opportunity to purchase a property. Withdrawing a lump sum to act as a deposit could mean their day-to-day costs fall and provide greater security when compared to renting, but restrictions might mean this isn’t possible. Or if they face a medical emergency, accessing the wealth held in a trust could enable them to receive treatment quicker or provide more options.

Contact us to talk about your estate plan

A trust is often just a small part of an effective estate plan. If you’d like to discuss how you might pass on wealth to loved ones in a way that aligns with your goals and considers your wider financial plan, please get in touch.

Please note: This blog is for general information only and does not constitute financial advice, which should be based on your individual circumstances. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

The Financial Conduct Authority does not regulate estate planning, tax planning, or trusts.