Watching a stock market plummet is troubling for most of us. The fear is that you will lose all of your money and there is a temptation to sell to stop the losses. Whilst that action might make you feel a bit better, there is no evidence that it is the right thing to do and long term: the evidence is very much against it.

With that in mind, here are some tips on what should calm your nerves in turbulent markets:

-

Remember why you are invested in the first place

We have agreed that there is a long-term reason for why you committed to an investment in the first place. Your retirement is often the reason and so making a short-term decision on a long-term plan doesn’t make sense. You would still turn up at the airport even if you knew that there was a three-hour delay at the airport, wouldn’t you?

-

Remain invested

The investments that took you into the dip are the best ones to take you out of it. Selling them is like jumping off the coach on the motorway because there is a traffic jam…at some point that coach will be whizzing past you and off into the distance.

And if you know your history…

Then you will know that stock markets have seen downturns resulting from wars, political unrest, economic recessions, and they have all recovered. This reinforces the idea that staying invested is the best thing to do and see out the storm.

-

Don’t look at your investments constantly

Similar to watching a kettle boil, it adds frustration, causes you to consider tinkering with things, and leads to further anxiety as well as encouraging you to reach false conclusions and overreact.

Remember: there is no evidence that anybody can reliably guess or predict markets and turns either up or down.

-

Be aware of the emotive language of news and newspapers

The idea of the media is to attract your attention. They do this by using emotional headline grabbers such as “billions wiped off the stock market”, but conveniently don’t mention that stock markets are valued in trillions and never mention when the markets go up.

Stay away from the doom and gloom of these commentaries: they make their money by grabbing your attention and misery sells!

-

Remain diversified

Our portfolios are spread across literally thousands of companies, their shares, government loans, corporate bonds, and property shares. Diversification is the only “free lunch” of investing, smoothing out the ups and downs of each other, since some will rise as others fall. Resist any temptation to sell the fallers in favor of the fallers.

In addition

Beware of the quack investment geniuses selling amazing alternatives as the “cure” for investment woes. They are jumping on the bandwagon of preying on insecurity.

Cash is what you use to buy things: it is not a long-term investment

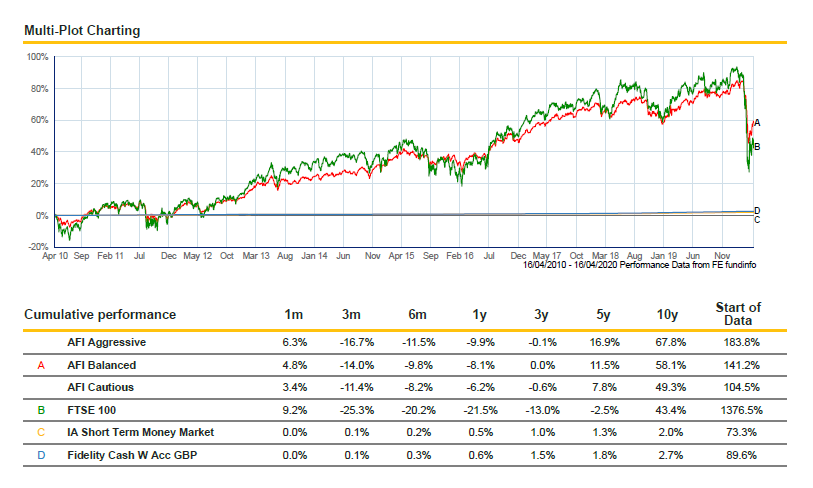

Cash has no history of being able to keep up with inflation and is worse now more than ever. As the following chart shows: