The last couple of months have forced businesses to adapt to a new normal. A common question asked by our clients has been ‘What have you been doing ‘in the background’ during the Coronavirus lockdown? As a company, we have made some positive strides to ensure we are still delivering our level of service to our clients.

In terms of planning, we have been doing a number of different things:

- Ensuring that payments are still being made.

- Dealing with other changes such as bank details etc, but a big part of it has been studying how the impact of coronavirus has affected our planning and the underlying investments that powers your wealth planning.

Is this unprecedented?

Several people have stated that the situation from an investment standpoint is unprecedented. The real answer to this is yes and no!

The reason why it is not entirely unprecedented is because of the components, which are:

- Market trading.

- An oil price war between oil producers.

- A global pandemic.

We have had global plagues since the dawn of history, so this isn’t new, but the impact of all three of the above, has meant that we now have a global lockdown, which is unprecedented.

In that sense, the overall impact of investment markets could be seen as unprecedented.

Our job is to ensure that the stock-market uncertainty that has followed the lockdown represents the stress testing that we have undertaken on the fund performances when we originally built your plan.

Here is our methodology.

The FTSE hundred

In our opinion, the FTSE hundred is probably the least representative of our clients’ wealth, because:

- It’s based upon 100 shares.

- All within the United Kingdom.

- There are no other assets, such as bonds or property in there.

In other words, because our client portfolios are diversified globally and aren’t just representative of stock markets, because they are also invested in property shares and corporate bonds, then the FTSE hundred is not a direct comparison.

We do refer to it though, because most of our clients believe that they are invested in the stock market and this is the index that is reported by the BBC and ITV. Consequently, it is probably the most recognizable aspect of investing for our clients.

In truth, there is some correlation between the fortunes of the stock market and client portfolios, or at least sufficiently so for us to consider the two.

A recent review

Here is the chart for 18 June, which was our last review, in respect of the FTSE hundred:

As has been the case for so long, the market dropped recovered and has dropped away again. When we are close up to the market, as in this case when we are looking over a day, then it looks incredibly volatile.

Typically, the FTSE hundred has been hovering around the “6000 mark” for some time.

This is demonstrated in the following chart:

We can also see the following from this chart, with more specific data added:

- The market peaked on 17 January 2020 at 7674

- it bottomed out on 23 March 2020 at approximately 4993.

- This is a fall of approximately 34.9%.

As you will recall, this was somewhat disturbing to world markets and investors, alike.

18 June it was effectively “only” down by 19.18%!

As financial advisers, with funds under advice for clients, then it is our job to ensure that we can see how this impinges upon our clients and assess if it is merited.

In other words, that clients are being rewarded for the risks that they take and that managers aren’t behaving in a way that we wouldn’t expect or would not agree with.

We then look at the behavior of the funds on the various platforms and investment products that we have in place.

So, have the clients bounced back?

Not entirely…we explain why, here.

For most of our funds under advice, then we need to look at platforms

Assets under advice

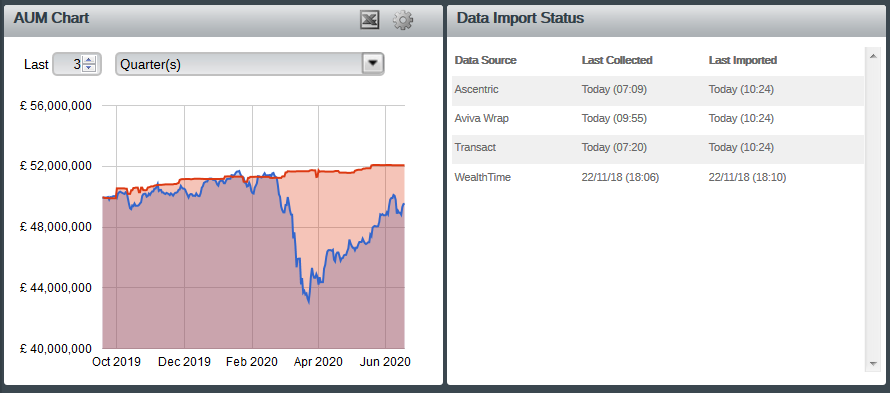

The following gives the figures for:

- Transact

- Succession

- Aviva

They omit the everything else, because the reporting technology is only in place to report on our platform business. (That is why we like platforms so much – they allow us to look at vast quantities of data).

As many of you will know, the platform is the electronic portal that we used to hold your investments.

This tells us that:

- Capital invested was £52,067,461 (This figure is adjusted for your income requirements and capital withdrawals).

- Value is £49,507,829

- Down by £2,559,632

- Or 4.916%

Scores on the doors

The results are then:

- FTSE 100 is still down by 19.18%

- Our clients’ total funds are down by 4.916%

We should also remember that there are other factors at play which don’t make these numbers quite accurate, such as:

- Client funds are after all expenses, which includes fund management charges, our charge, and the charge for the platform or other investment product.

- The FTSE 100 that is reported doesn’t factor those charges into their overall performance which will skew the performance to the positive side. A reasonable and possibly: a significant number of our clients are drawing income from the funds.

- The FTSE hundred is simply the market value of the top 100 companies on the London stock exchange, whereas our portfolios represent the aggregation of client portfolios across different markets and invested at different times.

In other words, our performance is even better than this.

Despite all of this, we are pleased that the funds have not been as badly affected overall as the FTSE hundred and have responded reasonably well as markets have improved.

From this, we conclude that the funds are behaving as we would expect and performing better than their peer group.

As ever, we continue to monitor investments in order that clients can be confident that they are still suitable to meet the needs of their planning.

Would we ever drastically change things?

The short answer to this is: yes.

The more practical answer to this is that long-term changes in investment planning shouldn’t be knee-jerk reactions.

We need to make sure that the investments are behaving in a manner that is suitable for your long-term goals, rather than reacting to short-term upsets.

We have an investment committee which oversees the funds that we have under advice if it was felt that a change needed to be made

Summary

Naturally, if we thought that the investments were totally inappropriate, then we would take drastic action. We typically look at things regularly to ensure that they are behaving as we would expect.

We believe that this course of action gives clients the confidence that they need to remain invested.

This is all reviewed with you directly at your review meetings, but on the constant monitoring.

If you have any questions or would like to speak to one of our advisers, then please do not hesitate to contact us.