The fantastic benefits of basing your financial plan on happiness

When you think about what you want the future to look like, it’s probably not the value of your assets that comes to mind first. Instead, you might think about the experiences you want or the wellbeing of your loved ones

Yet, to build the life you want, money is usually an important factor. While you often hear that “money can’t buy happiness”, the reality is that your financial circumstances are likely to play a role in whether you can secure the lifestyle you want.

By making your financial plan as much about happiness as your wealth, you could work towards your long-term goals and improve your overall wellbeing.

Combining your financial goals and happiness could improve your wellbeing

There are several excellent reasons to consider both your wealth and happiness when creating a financial plan.

First, financial stress can be detrimental to your wellbeing.

According to findings from the National Debtline, almost half of people in the UK were worried about money at the start of 2024 – the equivalent of 24.9 million people. Only 12% of people said they were not at all worried and felt able to cope financially.

Indeed, a report from Aegon found even among top earners, 1 in 3 people worried about their finances. So, taking control of your finances could improve your overall mental wellbeing.

In addition, it could focus on how you use your wealth to deliver outcomes that boost your happiness over the long term.

Rather than focusing simply on wealth creation, a financial plan would consider what steps you need to take to be able to reach your goals.

For example, after reviewing your finances, you might decide to reduce your working hours to phase into retirement sooner than expected. While that could mean the value of your pension is lower than if you continued to work, the free time you’d gain could be far more valuable. You might use the freedom to spend more time with your grandchildren or indulge in a hobby that brings you joy.

Making happiness a key part of your financial plan may allow you to make decisions that balance getting more out of your life with financial security.

3 valuable ways making happiness part of your financial plan could improve it

1. It gives you a chance to define what makes you happy

While you might work hard to build a fulfilling life, when was the last time you really considered what makes you happy?

According to the Financial Wellbeing Index from Aegon, just 1 in 4 people are very aware of the day-to-day experiences that give them joy and purpose in life. Similarly, only 1 in 4 people have a concrete vision of the things and experiences their future self might want.

This disconnect could mean some people are making decisions that don’t align with the future they picture for themselves.

By basing your financial plan on happiness, it provides an opportunity to set out what could improve your wellbeing now and in the future.

2. It could enhance your motivation to follow a long-term plan

Sticking to a financial plan over a long period can be difficult. However, knowing that your efforts will help you create the life you want may improve your motivation and help you stay on track.

If you daydream about retiring early, having a financial plan that’s been tailored to this goal might mean you’re less likely to pause pension contributions to fund short-term expenses.

So, putting your happiness at the centre of your financial plan could improve the outcomes.

3. It may help you calculate how much is “enough”

While money can’t buy happiness, it certainly can play a role in creating a life that will make you happy. Effective financial planning could help you calculate how much is “enough” for you.

Whether your goal is to retire early, have the financial freedom to travel more, or spend time with your family, financial security is often important for peace of mind. A financial plan could help you get your finances in order, so you can focus on what’s more important – enjoying your life.

Contact us to devise a financial plan that focuses on your happiness

If you’d like to work with us to devise a financial plan that places your happiness and wellbeing at the centre, please contact us. We’ll work with you to understand your goals and circumstances to build a tailored plan that suits your needs.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance.

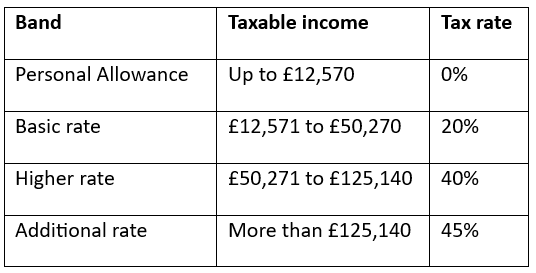

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates, and tax legislation may change in subsequent Finance Acts.