These are scary times. For most business owners, this is completely new territory, and the volume of things to think about ais completely overwhelming. We also know that burying our heads in the sand isn’t going to help. We firmly believe that it is possible to get through, and potentially even come out stronger on the other side. But this will mean making lots of difficult decisions, and sometimes you don’t even know where to start.

We’ve therefore pulled this pack together for you. It includes things to think about right now, while we’re in the thick of it. Some considerations for the other side of the Covid-19 outbreak (which will need thinking about sooner rather than later). And some areas to consider in the future, to be better protected should a disaster of a similar level occur. (which isn’t as unlikely as we might hope!) We hope this document helps answer some questions and gets some cogs whirring.

Right Now

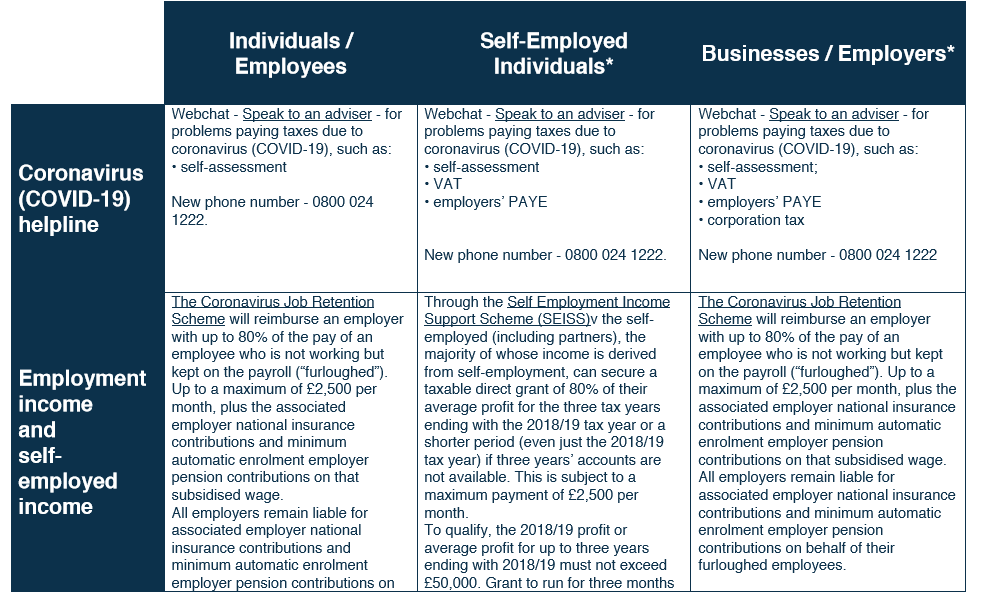

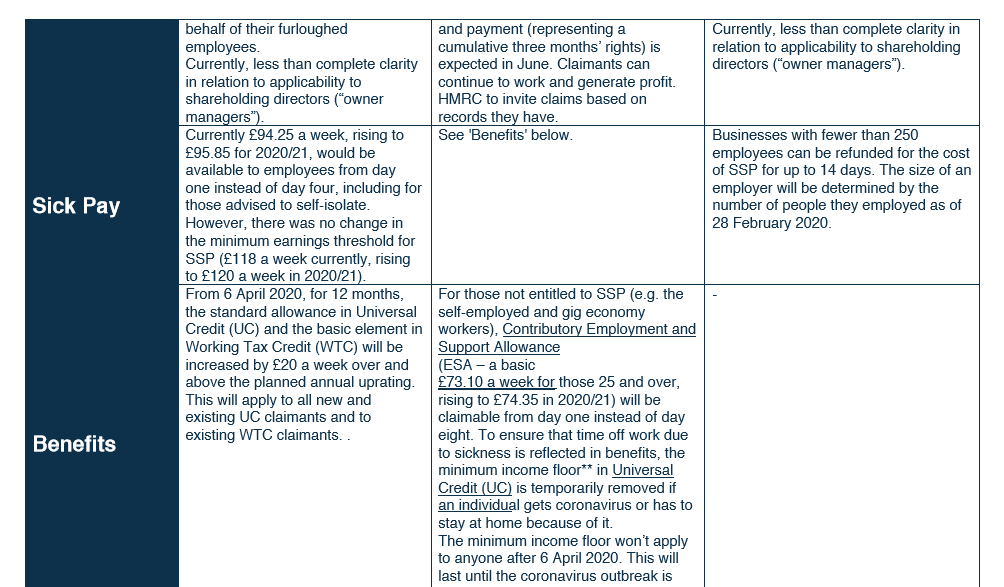

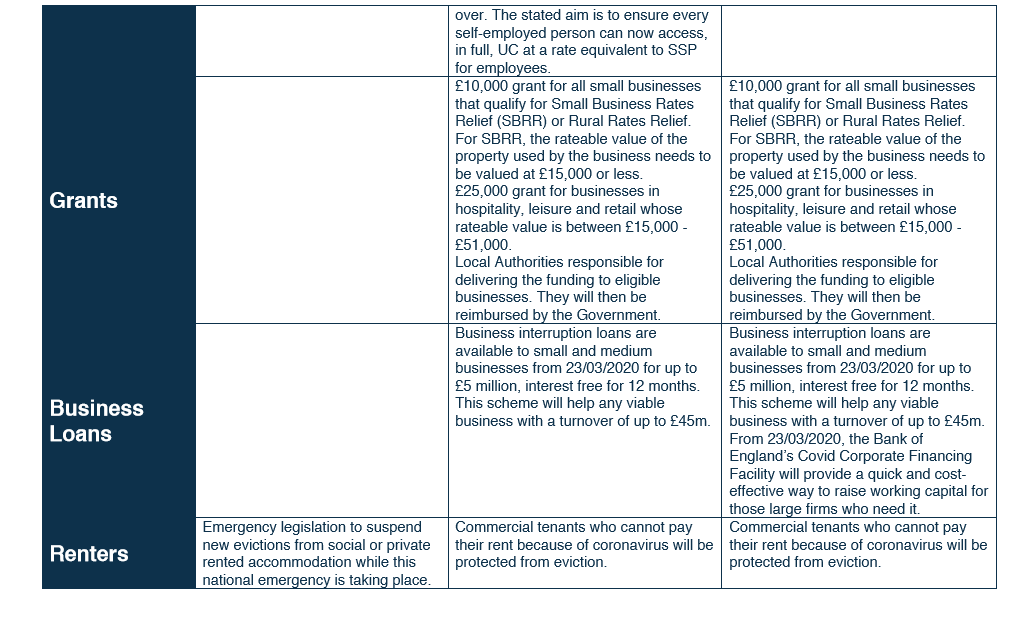

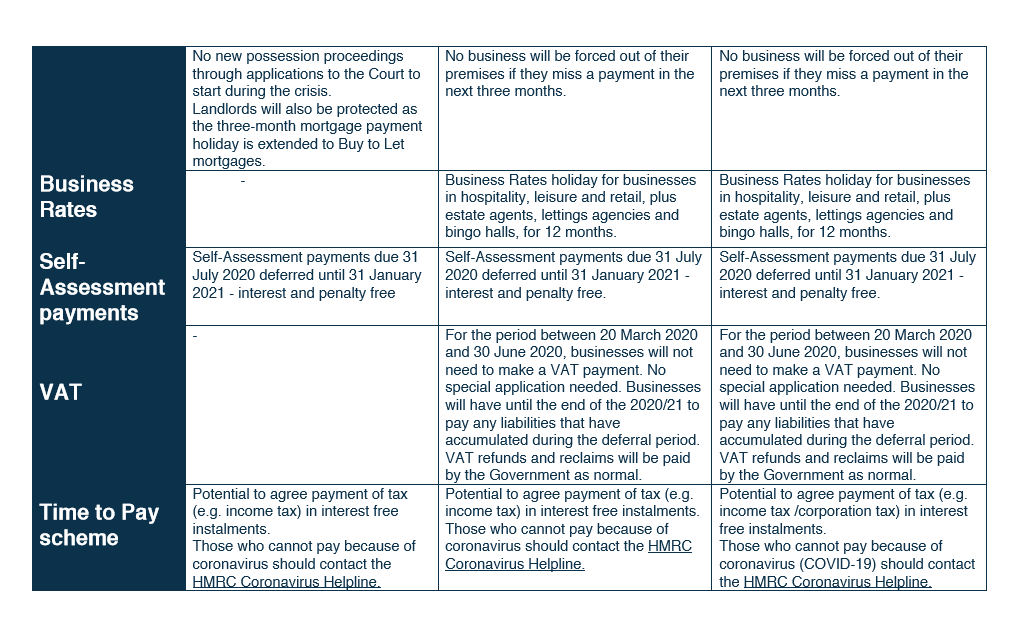

There’s a load of information out there; we know it’s overwhelming. We’ve pulled it all together in a summary for you here, with the relevant links. As you’ve probably noticed, this stuff is changing daily, so while we’ve summarised it, we’ve also included the links so you can see the latest information yourself by checking out the government websites. The good news? Due to the speed of new structures being put in place, the rules around them are fairly straightforward and the guidance is in plain English – always helpful!

*Note that, because some elements of business support are devolved, the measures a business can access may differ if it is in Scotland, Wales or Northern Ireland:

**The minimum income floor is usually what someone of the same age would earn if they worked at the National Minimum Wage for the number of hours that the self-employed individual is expected to work or look for work. Normally, if the self-employed individual earns less than the minimum income floor, UC will not make up the difference.

*** Source of data – Technical Connection.

Furloughing

A word none of us were familiar with before now, but is suddenly on the tip of everyone’s tongue. What does it involve and do you need to consider it for your staff? Again, the Government website is fairly straightforward on this link (though simplicity can also equal confusion as people search for more detail). The key points:

- The actual name is the Coronavirus Job Retention Scheme. And that’s its purpose. To help companies find a way to retain staff. The ideal scenario (from the Government point of view) is that they essentially provide a cash buffer, to help out businesses while work has dropped off, enabling them to retain staff and put them back to work when business picks back up.

- Clearly there are no guarantees of when business will pick back up, or at what level, and so the rules are flexible that if there is still no work available redundancy would still be an option open to employers at that time.

- The key point with furloughing is that employees are still employed, and have to be treated that way. But they are not able to work. They can’t do any work at all for the business.

- The government will cover 80% of their salary (up to £2,500 per month). Some companies are electing to top this up, so the employee still gets 100% of their salary and the company is still saving money. This can work where the entire staff is being furloughed. If, however, you are only furloughing part of your staff, consider the implications on those who are still working; being paid at the same level as someone undertaking no work at all.

- Normal non-discriminatory rules apply when determining who to furlough.

- The actual system isn’t yet set up (they’re aiming for the end of April) which means you still need to have sufficient cash to pay salaries for the short term, with the aim of reclaiming it via this scheme. If you aren’t able to do that, and are struggling to access any other sources of funding (see previous table) redundancy may be the only option available right now.

There is no easy answer and whether or not to furlough will vary massively from firm to firm. Consider your current position, cashflow for the next few months, and what you genuinely believe (not hope) the uptake in work will be post-Covid-19. Applying brutal honesty to your own business plans will help you make the best possible decisions for you and your team right now.

Some other things to think about right now:

Client communications

Stay in touch with your clients. If you’re nervous, they’re nervous. And just being on the phone and saying “hey, I’m nervous too” can make all the difference. Ask what their challenges are, and what is keeping them up at night. You might find that you can do something to help them with that, which will come back to you ten-fold when things settle back down.

Cashflow forecast

No head in the sand moment with your cashflow. Look at your expenses, your bank account, and project forward a worst-case scenario. Income dropping by 50% for 3 months? What about 80%? What about 6 months? Once you do it, you’ll know where your crunch points are, and it’ll help you make decisions much quicker and more accurately. Bite the bullet and do it (there’s lots of software available or a simple spreadsheet will suffice).

Look after your team

Whether you need to furlough them or not, be kind, open, and supportive with your team. They are just as worried and uncertain as you are right now. Communicate regularly, share wellbeing tips with them. And work hard to keep them motivated and engaged. With or without a furlough period, the hope is to come out the other side with a strong team still in place, and stepping up for them now will do wonders for embedding their loyalty to your firm in the future.

Consider outsourcing

One of the opportunities out of the current challenges is that businesses are likely to come out the other side much leaner and more efficient than they were beforehand. The necessity of cutting back enhanced creativity and new ways of doing things, and outsourcing things that don’t need to incur internal costs and salaries, is likely to be a big part of that. Focus on efficiencies and reducing unnecessary expenditures where possible.

Immediate Post Covid-19 Considerations

It’s potentially quite some time away, so we won’t dwell on it too much, but just to get your brain pondering some things for when we emerge out the other side:

- Ending furlough (or ending contracts) – how that will look? What do the remaining roles look like?

- Property/offices/leases – has enforced home working made you question just how much office space you actually need?

- Recruitment – redundancies will likely be because that role is no longer required. Innovation during this time is likely to mean new roles are needed. The sooner you start recruiting for the new roles, the better.

- Contracts of employment – in fact, all HR documents – highly likely to need a big review after this.

- Date protection – another area likely to need a bit of a refresh, both employees and clients.

- Doing what you did pre-Covid-19 is unlikely to work. Time to start adapting and building the business you thought you might have in the future…

- Your market – whatever sector you’re in, it’s likely to look very different afterward. Some competition will have gone. Some new ones will appear.

Future Planning

As a business owner, there are specific areas that you probably always knew you needed to think about, but might not have always been top of your list of priorities (but will be heading there now!)

None of us like to think of this, but the fact is, you’re not going to run that business for all of eternity. Something will change at some point. Having a plan in place, and a contingency plan should anything happen before Plan A can take effect, is crucial.

Succession planning

Right now, we’re facing the very real threat of losing people, through illness or worse, and as a business owner, there will be people in the company whose lack of presence will have a huge impact. It’s important to consider: Insurances

Key Person Assurance Shareholder Protection Executive Income Protection

to protect the business, and the key individuals, in the event of something catastrophic happening. Likewise, it is vital to ensure you, your directors, and any key people in the business have a valid will in place.

Wider Planning

As a business owner, there are a range of options available to you. For example, you can use funds accrued in your pension scheme to provide a loan to your business (via an SSAS) if you need a cash injection and are struggling to get a bank loan. You might also look to take advantage of depressed property prices and purchase your company premises, and, again, a pension (such as a SIPP) can assist with this. There’s a huge range of planning options available, beyond the scope of this document, but definitely worth considering and chatting through with an adviser.

If you have any questions or concerns during this uncertain time, then please get in touch and we will do our best to help in any way we can.